Investment Strategy

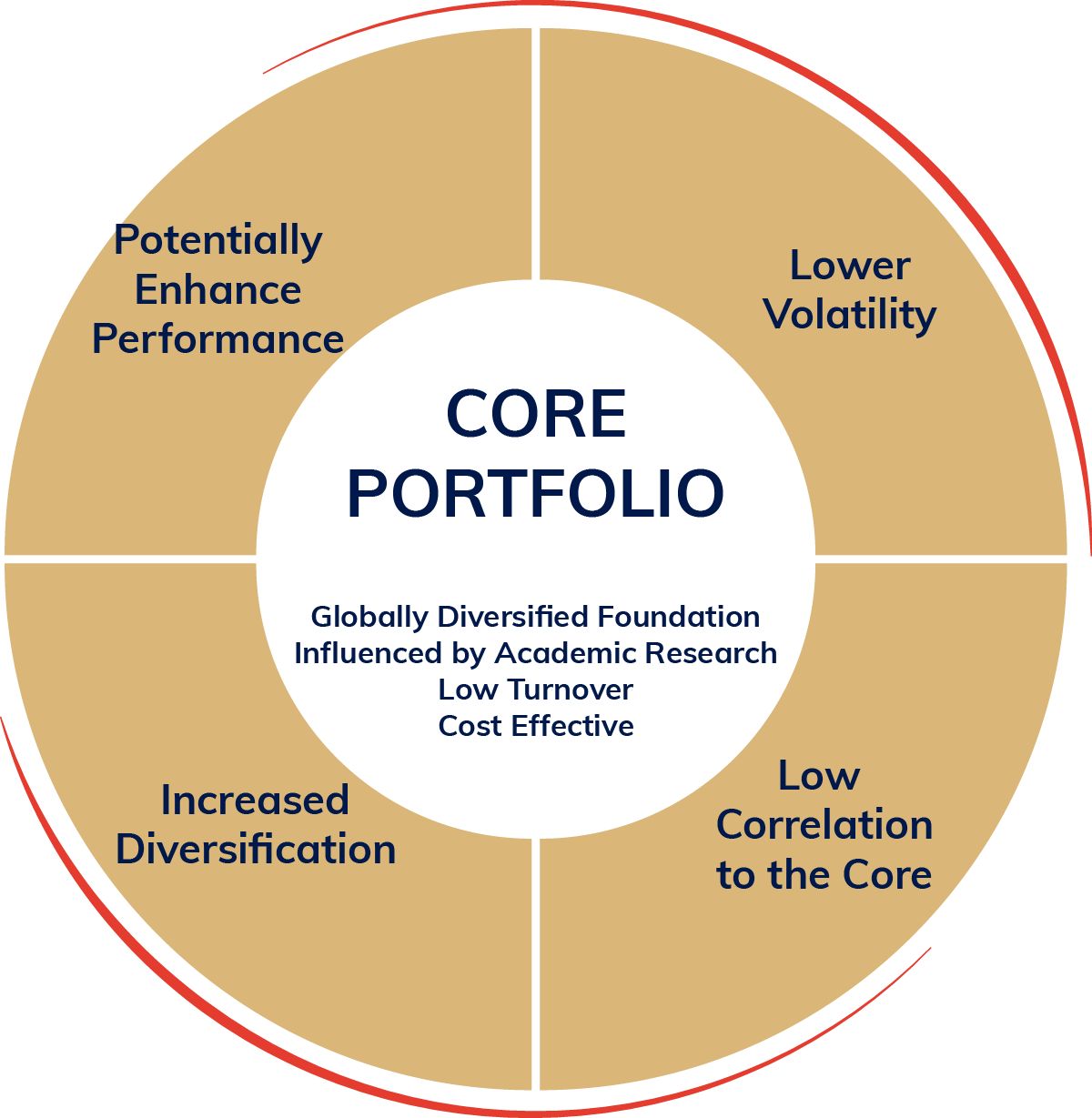

EMB Fund Limited Utilises a Core-Satellite Investment Approach

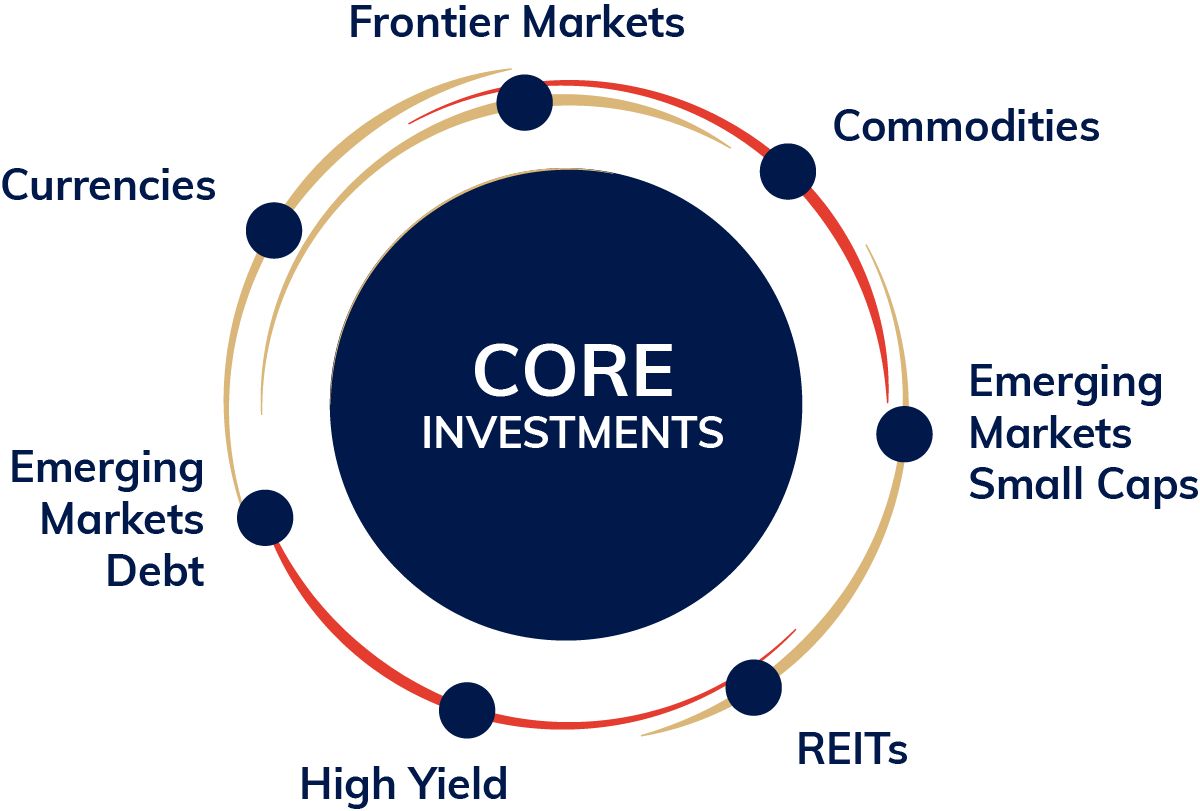

Core-Satellite Portfolio Management is an investment strategy that incorporates traditional fixed-income and equity-based securities (i.e. index funds, exchange-traded funds, passive mutual funds, etc.) as the “Core”. The balance is invested across bespoke individual securities and is known as the “Satellite”.

To gain performance in the Satellite, the Fund may utilise high risk securities including low credit quality and distressed securities, which can become illiquid. The Fund may at times use highly speculative investment techniques including short-selling, high leverage, futures, swaps and notional principal contracts, currency speculation, short sales and uncovered option transactions.

Both Core and Satellite portfolios are constantly reviewed and rebalanced to manage risk and to take advantage of ever-changing market movements and forecasts.

Fund Investment Objectives

The objectives are to offer growth that outperforms world stock markets. This will mean exposure to risk. There is no guarantee that in any time period, particularly in the short term, the Fund’s portfolio will achieve appreciation in terms of capital growth. Investors should be aware that the value of Participating Shares may fall as well as rise.

Investment Portfolio

In seeking higher return, alongside managing risk at all times, the Fund will invest all of its available capital (other than monies the Investment Committee retain in cash or cash equivalents) in trading programs, securities and other intangible investment instruments. While some of these instruments are traded in public markets, markets for such instruments are generally subject to fluctuations. The market value of any particular investment may be subject to substantial variation. In addition, such securities may be issued by unseasoned companies and may be highly speculative. No assurance can be given that the Fund’s investment portfolio will generate any income or appreciate in value.